1/ The Core System

The system is based on digitizing all fundamental tax operations and procedures, such as (registration, declarations, assessments, payments, etc

2/ The E-Portal:

It enables taxpayers to conduct several tax transactions remotely, such as (registering a new taxpayer, obtaining a tax identification number, viewing registered data, updating taxpayer information, submitting tax returns electronically, reviewing and amending returns according to the law, viewing the taxpayer’s account movement, requesting a clearance certificate, and paying tax obligations electronically).

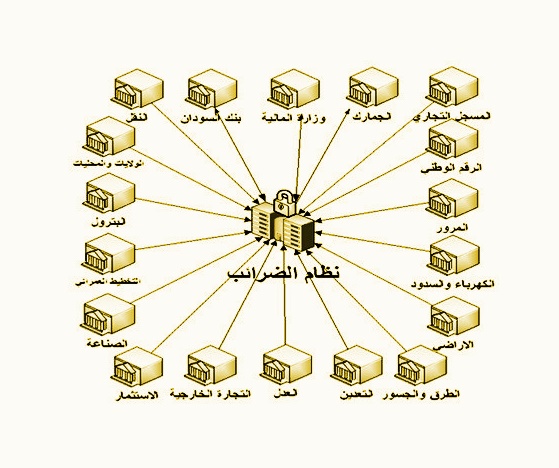

3/ Integration with Information Sources:

A total of 18 relevant entities have been identified for integration, with priority given to systems that provide supporting information for tax operations (Customs Authority, Civil Registry Authority, Commercial Registrar, Accounting Bureau, Central Bank of Sudan, Ministry of Trade). This project has been implemented at over 80%, and work on it continues to date.

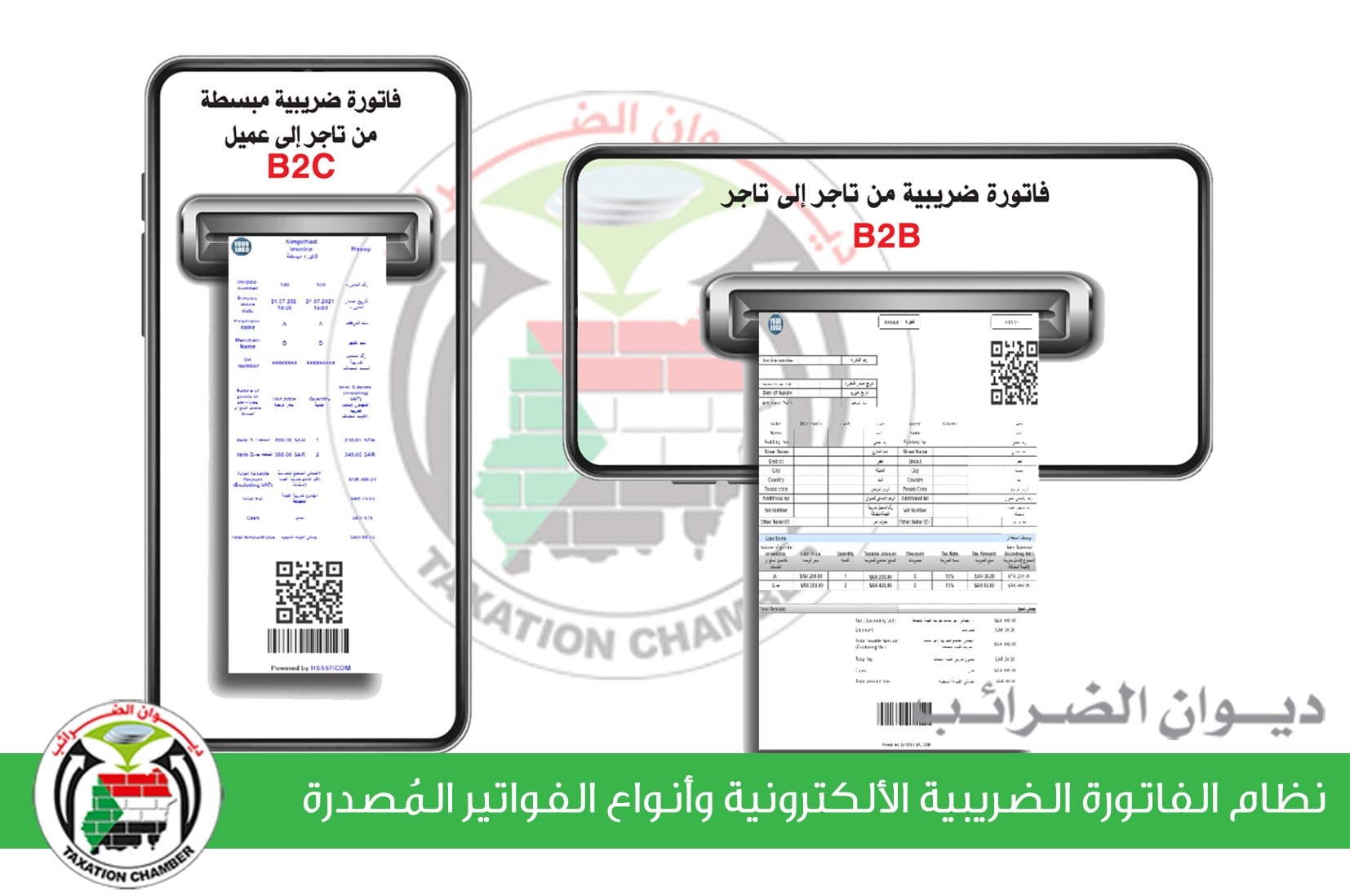

It is a system used by taxpayers to issue invoices electronically. The information is sent in real-time to the Tax Authority and then distributed electronically to the taxpayer records in the core tax operations system. This project is considered one of the most important technological solutions that could contribute to maximizing revenue and expanding the tax base, as it provides direct and real-time information

Components of the Electronic Invoice System:

1/ Invoice Operations Management System:

This system is used by tax authority staff to register devices and link them with the electronic taxpayer records in the core system. It also handles all settings required by the tax authority, such as (product and service settings, tax rate settings, and others).

2/ Electronic Invoice Devices:

These are the devices used by taxpayers to issue invoices. These devices vary depending on the users. There are financial processor devices used by taxpayers dealing with BrB taxpayers, and there are payment registration machines used by taxpayers dealing with final consumers (BrC).

3/ Taxpayer System:

These are the interfaces used by the taxpayer to issue invoices and perform their specific settings, such as defining goods, prices, and other related details.

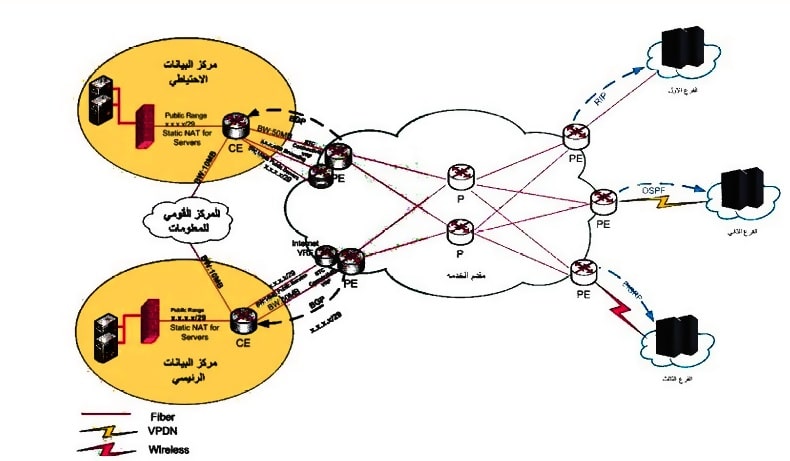

The project includes:

1/ Internal Networks (LAN):

The connectivity for all offices across the various states of Sudan has been completed, whether it is the connection of devices within the offices or connecting the offices to the data center.

2/ External Networks (WAN):

An agreement was made with companies operating in the field of remote connectivity (Sudatel, Knar, and MaxNet) to supply all tax offices with two remote connection lines.

It was ensured that the type of connection used varies, with each office being connected using two different technologies, except for the Tax Authority Headquarters, which was connected with three lines, and the Arab Market Towers and major taxpayers’ offices in Khartoum, which were connected using fiber technology with two lines from service providers (Sudatel and Knar) to ensure continuous service.

3/ Data Centers:

A contract was signed with a data center (Sudatel Company) to provide colocation services for the main tax authority data center under a leasing system.

The tax authority procured its own hardware and equipment, while Sudatel provides services such as insurance, operation, internet, electronic and physical monitoring, and other necessary services for the operation of the data center at Level 4 service.

A data center has been established at the headquarters of the Tax Authority Tower, and the work is 100% complete. After providing servers, storage devices, and insurance, it can become the primary data center.

The Tax Authority is working on the electronic payment project through various methods that are being activated, with the aim of facilitating taxpayers and providing multiple channels that enable them to settle their tax obligations.

These channels differ in their operational methodology. There is an electronic payment channel that can be accessed remotely from anywhere the taxpayer is located, using the Tax Authority’s electronic portal (E-Portal), and it is currently in progress.

Additionally, there is another operational method through the activation of electronic payment channels (Point of Sale – POS) within tax offices.

The following has been accomplished:

The system has been set up, and bank accounts have been added for 70 offices. Permissions have been granted to 169 accountants at federal and state offices in Khartoum.

169 accountants have been trained to work on the system, and 54 technicians have been trained to provide technical support.

The project was launched experimentally at the Large Corporations Center, Medium-sized Corporations Center, and the National Contribution Administration.

Work is ongoing to expand the electronic payment system to include all offices across the various states.

1/ Change Management:

As is the case with the implementation of any program or project that aims to change operational systems and processes, it is essential to adopt change management practices to ensure the successful implementation of the project. This is necessary to control the natural resistance to change from employees, which can lead to delays or even failure of the project.

The Tax Authority has set up a Change Management team to adopt and facilitate the change smoothly, aiming to enhance the success of the project and enable the authority to achieve the desired outcomes.

Change management has been adopted using an organized methodology to support employees within the authority in accepting the change and transitioning from their current state to the future (targeted) state. This process involves understanding how employees deal with change, what they need, and what will help them successfully transition. It also involves identifying the key messages they need to hear and the optimal timing for training them on new skills that will enable them to integrate quickly into the changing system.

2/ Capacity Building:

Training and capacity-building programs have been designed for all employees at the authority to meet the needs of the project. These programs included:

Comprehensive training for all technical staff in a mandatory course on networks and maintenance for 220 technicians.

Advanced training for: 20 database managers, 24 system developers, and 30 network managers.

Basic computer skills training for 4,180 employees.

Training on using the core system for 4,000 employees.